Tax Rates & Fee Schedule

According to State law, property owners within the City limits are required to pay property taxes to the City of Marfa as well as to Presidio County, Marfa Independent School District, and the Big Bend Regional Hospital District. The Presidio County Tax Office produces the annual tax bills based on the tax rate and appraised market value. Payment can be made in person or mailed to the Presidio County Tax Office in the Presidio County Courthouse at 300 Highland Street.

The City’s tax rate is comprised of two rates: a maintenance and operations (M&O) rate and an interest and sinking rate (I&S). The revenue from the M&O is used for administration, law enforcement, volunteer fire services, municipal court, streets and sanitation, and community services (library, nutrition, center, swimming pool) while the I&S pays for the City’s outstanding tax debt obligations.

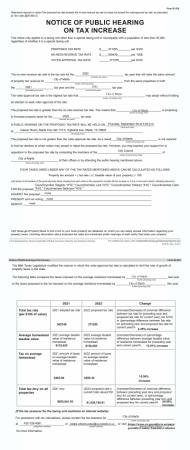

The City of Marfa's City Council will hold a Public Hearing on Thursday, September 29, 2022 @ 5:30pm to take

public comments on the proposed property tax rate for 2022.

*See Below for the Notice of Public Hearing on Tax Increase*

The City’s current property tax rate is $0.363 to the $100 in taxable value.

City of Marfa Tax Rate History:

- 2022 - $0.371

- 2021 - $0.363

- 2020 - $0.417

- 2019 - $0.478

- 2018 - $0.444

- 2017 - $0.4555

- 2016 - $0.4438

- 2015 - $0.4430

- 2014 - $0.4500

The City holds public hearings before the tax rate is set.